OVER the past few decades it has become clear that innovation—more than inputs of capital and labour—is what drives a modern economy. In the developed world, the application of technological know-how and scientific discoveries by companies, institutions and government establishments accounts for over half of all economic growth. Because of its seminal influence on wealth-creation in general and employment in particular, the manner in which innovation functions—especially, the way it comes and goes in Darwinian bursts of activity—has emerged as a vital branch of scholarship.

What researchers have learned is that waves of industrial activity, first identified by the Russian economist Nikolai Kondratieff in 1925, have a character all of their own. Typically, a long upswing in a cycle starts when a new set of technologies begins to emerge—eg, steam, rail and steel in the mid-19th century; electricity, chemicals and the internal-combustion engine in the early 20th century. This upsurge in innovation stimulates investment and invigorates the economy, as successful participants enjoy fat profits, set standards, kill off weaker rivals and establish themselves as the dominant suppliers.

Over the years, the boom peters out, as the technologies mature and returns to investors slide. After a period of slower growth comes the inevitable decline. This is followed eventually by a wave of fresh innovation, which destroys the old way of doing things and creates conditions for a fresh upswing—a process Joseph Schumpeter, an Austrian economist, labelled “creative destruction”.

Back in the late 1990s, Babbage noticed that the waves of innovation had begun to speed up (see “Catch the wave”, February 18th 1999). The industrial waves Kondratieff observed in the 1920s came every 50-60 years or so. By the late 1990s, fresh ones were arriving twice as often. Fifteen years on, their frequency appears to have doubled yet again. Waves of new innovations now seem to be rolling in every 10 to 15 years.

It is not hard to see why. Rather than leave things to chance, all the big industrial countries nowadays have legions of engineers and scientists scanning the literature for ideas that portend blockbuster innovations capable of carving out new markets. Meanwhile, social networking has made it easier than ever for money and talent to join forces in order to hustle the innovation process along. In addition, today’s far broader channels of communication ensure that any new way of doing things becomes instantly known to everyone interested.

Sometimes too well-known. Indeed, the hyperbole surrounding many fledgling technologies, especially those in their early stages of development, can prove a costly distraction for the unwary. Firms on the fringe of some new development may have difficulty filtering the message from the hubbub, allowing expectations to lose touch with reality. Believing some emerging technology (say, 3D printing) is about to transform their industry, they may make aggressive investments that will prove disastrous if the technology’s impact turns out to be less than anticipated.

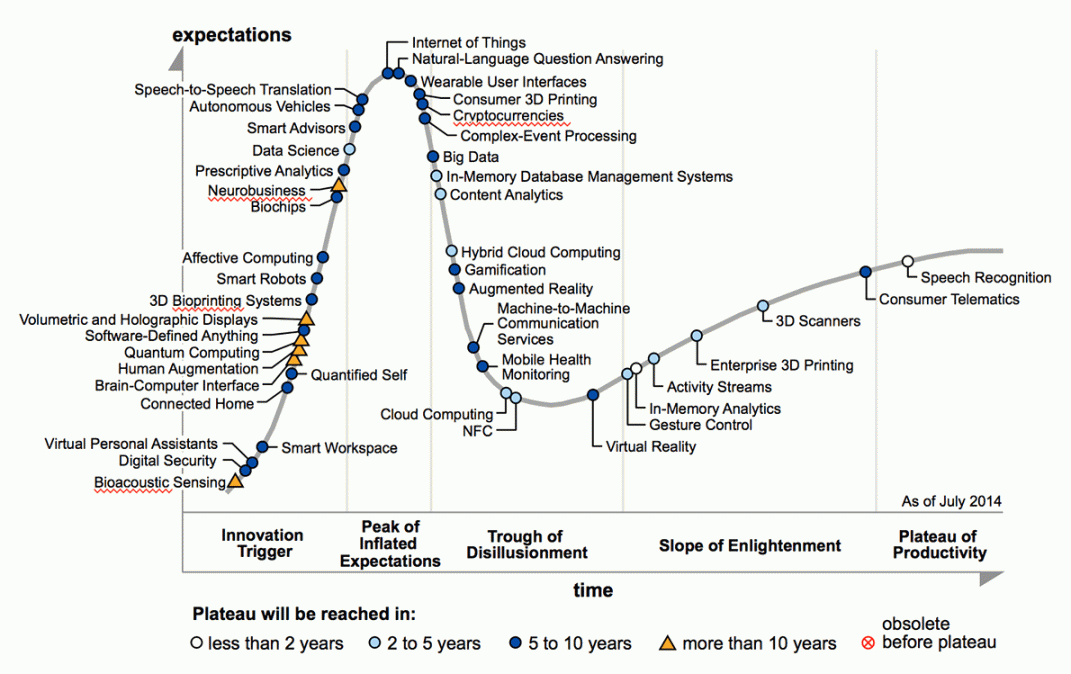

To help companies manage such expectations, Gartner, an information-technology consultancy based in Connecticut, has built a set of decision-making tools based on its so-called “hype cycle”. For the past 20 years, the consultancy has produced an annual update of various hype cycles that provide snapshots of the progress certain technologies have made over the previous year; where on the innovation cycle they currently reside; and how long (if ever) they will take to reach maturity. This year’s collection (published on August 11th) assesses the prospects of some 2,000 technologies, grouped into 119 aggregated areas of interest. The graphic above illustrates many of the points on this year's curve, each categorised by the time until a technology's projected maturity in the market.

Each hype cycle shows how expectations change during five key phases of a technology’s life cycle. The first phase (“Innovation Trigger”) happens when the news media begin to notice a promising new technology. Even though no usable product may exist and the technology’s commercial viability is still a long way from being proved, media interest begins to gather steam.

At the top of the cycle (“Peak of Inflated Expectations”), the early publicity prompts a number of success stories, while scores of failures receive less attention. During this second phase, some large early adopters get involved, spurring further headlines.

In the third phase (“Trough of Disillusionment”), interest wanes as trials fail to deliver results and press coverage turns negative. A shake-out drives weaker participants to the wall, while survivors with better products consolidate and gain support from early adopters, along with additional funding from venture capitalists.

With the fourth phase (“Slope of Enlightenment”), more enterprises approve pilot schemes, as they become acquainted with the technology’s proven benefits and best practices. Meanwhile, second- and third-generation products begin to appear, providing the needed confidence for mainstream adopters to think about committing themselves.

Finally, the fifth phase (“Plateau of Productivity”) is where mainstream adoption takes off. Firms providing the technology are now seen as credible suppliers. Their products gain broad market appeal, as the technology's value becomes recognised by the industry as a whole.

But the shake-out along the way is considerable. A good example is the chart for emerging technologies—Gartner’s longest-running and most comprehensive annual hype cycle. This provides a close-up of those technologies that possess both broad industrial relevance and the promise of at least a high, or even transformational, impact on firms affected. Of the 45 emerging technologies in this year’s snapshot, 17 are the subject of rising expectations, ten are at the peak, 11 are sliding into the trough, six have begun to climb up the slope towards viability, and just one (speech recognition) has made it to the plateau of mainstream acceptance. Only the fittest seem to survive all the hyperbole.

Perhaps the most cautionary hype cycle of all, though, is the one for personal 3D printers. Here, Gartner identifies two themes. The first is that the enterprise market and the consumer market for 3D printers are driven by entirely different uses and requirements. As such, they bear little resemblance to one another. For instance, there are 40 or so established manufacturers selling enterprise-class 3D printers to business for $100,000 and up. By contrast, more than 200 start-ups are hoping to crack the consumer market with 3D printers priced as low as several hundred dollars.

The second point is that 3D printing is not one technology, but a combination of seven different ones. “Hype around home use obfuscates the reality that 3D printing involves a complex ecosystem of software, hardware and materials, whose use is not as simple as ‘hitting print’ on a paper printer,” notes Pete Basiliere, research vice-president at Gartner.

The hype cycle for 3D printing shows some of the technologies involved are maturing faster than others, and could be widely available within a few years. For instance, the use of 3D printing for making prototypes—a mainstay of the industry since its inception—is enjoying increasing acceptance in business. But prototyping is unlikely to be of much interest to home users. Besides, despite the broad awareness and media buzz, even the prices of personal 3D printers that are being banded around are still too high for typical do-it-yourself consumers. Overall, says Mr Basiliere, consumer 3D printing is five to ten years away from mainstream adoption.

Babbage thinks even that may be optimistic. Several months ago, he wondered aloud whether 3D printers would ever make it into the home, if the only things they could fabricate were small trinkets and gew-gaws out of soft or brittle plastics (see “Making the cut”, June 2nd 2014). He felt that, to have any practical value, personal 3D printers should be able to make load-bearing components—to repair things around the home like lawnmowers, washing machines, children’s bicycles and old cars. To do that would mean being able to print with powdered metals.

But, while industrial metal printers that use selective laser sintering do an excellent job, they cost $125,000 or more. Their price would have to come down by two orders of magnitude to have any chance of making it into the home.

Consumer 3D printing is still at its hype cycle’s peak of expectations. Whether it survives the coming slide into the trough of disillusionment, with the inevitable shake-out of suppliers, is still too early to say. Babbage hopes it does, but that the survivors focus more on reducing the cost of making things that are genuinely useful rather than merely ornamental.

The 2014 Gartner hype cycle chart, with all technologies identified

For more:http://www.economist.com/blogs/babbage/2014/08/difference-engine-2?fsrc=scn/fb/te/pe/ed/diviningrealityfromhype

Comments